Card machine for MEI, everything you need to know!

Are you increasing your sales and need a card reader for your MEI? Then learn about the best options!

Advertisements

Brazil has seen the highest rate of increase in the number of individual microentrepreneurs in recent times.

This increase is due to the profile of this generation and the employability conditions in the country, as due to the pandemic, the number of unemployed individuals has also increased considerably.

The good news is that Brazilians have reinvented themselves and are even starting to profit more from their own businesses. If you're one of these MEIs looking to grow, there are some basic tips you should follow.

One of them is having a card machine for MEI, which has exclusive advantages and very interesting benefits, so you don't lose any sales by not accepting cards!

Curious to learn more? Then keep reading to learn all about the best card machines and their main advantages.

Easy MEI

How does it work?

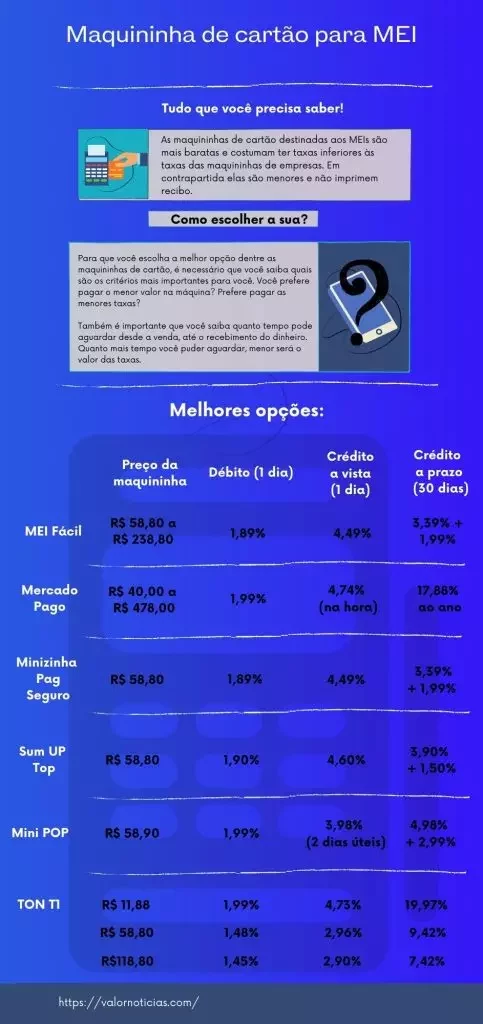

The MEI Fácil card reader is from Pag Seguro. It offers both credit and debit functions in the same machine and offers a wide range of card options, accepting eleven different card brands. It comes in two versions: the Minizinha Chip and the Moderninha Plus. Both have fees.

What are the advantages?

The advantages are that both machines have a chip slot, eliminating the need for a cell phone for them to work.

How do fees work?

The fees for both Pag Seguro card machines are the same. These fees depend on when you want to receive your sales and whether the payment method is debit or credit.

For purchases made using the debit function, the amount will be credited to your account within 1 business day and the fee is 1.89% per purchase.

In the credit function, you have two options to receive the money: in 1 business day or in 30 days.

For 1-day credit, the rate is 4.49% in cash and 4.59% in installments, plus 1.99% in both cases. For 30-day credit, the rate is 2.89% in cash and 3.39% in installments, plus 1.99% in both cases.

How to apply?

To apply, go to the Pag Seguro website and click "Apply now." Then, choose whether you want the Minizinha CHIP 2 or the Moderninha Plus.

Moderninha Plus is more expensive, but has twice the battery life of the first. If you're already registered on the MEI Fácil website, it's simple: just enter your CPF and make the purchase.

If you don't have a registration yet, you must download the app, register and then tap the “Card Machine” button to request yours.

Mercado Pago card machine for MEI

How does it work?

Mercado Pago has four options for MEIs, all of which are part of the Point line.

They are very versatile, as you can choose the machine that best suits your business and pay an amount proportional to the benefits you need.

Among the options, all serve the main eleven brands and offer excellent value for money.

What are the advantages?

The biggest advantage of Mercado Pago's terminal over its competitors is that it offers instant payment! While other companies take at least one business day to process payments.

How do fees work?

Mercado Pago terminal fees depend on your needs. You pay for the terminal upfront and then pay per transaction.

Machine prices range from R$$40.00 to R$$478.00. Fees are the same for all machines: R$1.99% for debit sales and instant cash disbursement.

For credit sales, the rates depend on when the money arrives in your account. For sales where the credit is received immediately, the rate is 4.74%; for those received within 14 days, the rate increases to 3.79%; and for those received within 30 days, the rate is 3.03%.

How to apply?

To request it, you must enter the Mercado Pago website and choose between the 4 available options.

It's worth carefully considering which option is best for your business. After choosing your card reader, click "Buy Now" and enter your information and payment method.

The machine will arrive at your home and you can contact the company's customer service team if you have any questions.

Card machine for MEI Minizinha PagSeguro

How does it work?

PagSeguro's Minizinha machine is one of the options mentioned in MEI Fácil.

With a longer battery life, it has all the features of the Moderninha Plus, but at a more affordable price. It doesn't have the option of a cartridge for printing customer receipts, but it's a great option for those who don't want to pay a lot for the device.

What are the advantages?

The advantages are that it has no rental or membership fees. Its rates are also quite attractive.

How do fees work?

The PagSeguro Minizinha card reader costs 12 installments of R$4.90 or R$58.80 in cash. Additionally, the card reader's fee for debit sales with one-day payment is R$1.891. For credit purchases, you can choose the Advance or Economy plans. With the Advance plan, you receive your payment in one day, and the fees are as follows:

| 4,49% in cash |

| 4,59% in installments |

| +1.99% per installment |

On the economic plan, you receive the sales amount in 30 days, but the fees are much lower:

| 2,89% in cash |

| 3,39% in installments |

| +1.99% per installment |

How to apply?

To request, you must go to the Pag Seguro website and click on “Order yours now” in the Minizinha CHIP 2 column.

If you're already registered on the MEI Fácil website, it's simple: just enter your CPF and make the purchase. If you're not yet registered, download the app, sign up, and then tap the "Card Machine" button to request yours.

Sum UP Top

How does it work?

The Sum UP Top card reader accepts the eight main credit cards on the market. Like the Minizinha, this is also a good option for those looking to save money and who don't have a receipt cartridge option.

It has a unique design and is much smaller than its competitors.

What are the advantages?

The difference with this machine is its size, which is much smaller than machines from competing companies.

It also offers a bonus of R$100.00 for companies that reach R$2,000.00 in sales. It's also minimal bureaucracy, which is a plus for micro-entrepreneurs and small businesses.

How do fees work?

For debit sales and one-day receipt, the rate is 1.90%. Now, for credit, there are two payment options.

The advance plan, where payment is made within one day, has a rate of 4.60% for cash sales, and an additional 1.50% for installment purchases. The economy plan, where payment is made only 30 days after the sale, has a rate of 3.10% for cash sales and 3.90% for installment purchases of 2 to 12 times.

How to apply?

To request this machine, you must enter the Sumup website and select the card reader option. The SumUp Top is the cheapest option, costing R$1,400,000.

Card machine for MEI Mini POP

How does it work?

The Mini Pop is Credicard's most affordable card reader, ideal for those looking to save money and have a portable, affordable card. It accepts eleven major credit cards, including Alelo, Cabal, Sodexo, and Ticket.

What are the advantages?

In addition to its size making it easy to move the machine, it also has the advantage of having a long-lasting battery.

How do fees work?

The fees for this machine are as follows: R$ 1.99% for debit sales and receipt in 1 business day, R$ 3.98% for cash credit and receipt in 2 business days and R$ 4.98% + R$ 2.99% per installment from the second installment for installment credit.

How to apply?

To request the machine, you must find an accredited consultant or contact Credicard through one of the following telephone numbers:

- 3003 1004 for all of Brazil (landline and mobile)

- 0800 757 1004 for locations outside capital cities and metropolitan regions (landline only, Monday to Saturday, 8am to 8pm)

- 0800 202 7333 to speak to the ombudsman.

TON T1

How does it work?

The Ton company has three lines of machines, however the most affordable is the Ton T1 Giga.

Like other machines in this category, it doesn't have a SIM card and requires a cell phone to operate. It also doesn't have a receipt cartridge and sends receipts via SMS.

What are the advantages?

The great advantage of the TON T1 is that it gives you the option of purchasing the machine at a much more affordable price than the others.

However, this advantage is only worthwhile for those who will sell a small amount through the card reader, as the fees are much higher. Another interesting advantage is that it offers the lowest fees among its competitors.

How do fees work?

This device has a unique feature: you can choose a pricing plan that suits your company's needs.

The three plans available are the GigaTon, the MegaTon and the Basic Tone. Each of them has the fee value linked to the amount initially paid on the machine.

If you want to pay less for your card reader, the basic plan is ideal, as you'll only pay R$1,400,000 for the card reader, but the fees are higher. The higher the card reader's price, the less you pay in fees. See the prices:

| Machine Price | Debit Fee (1 business day) | Cash Credit Rate (1 business day) | Cash Credit Rate (30 days) | Installment credit (30 days) |

| R$ 11.88 | 1,99% | 4,73% | 3,02% | 19,97% |

| R$58.80 | 1,48% | 2,96% | 2,94% | 9,42% |

| R$118.80 | 1,45% | 2,90% | 2,88% | 7,42% |

How to apply?

Requesting this machine is very simple! Just go to Ton's website and choose the ideal plan for you from the three available: GigaTon, MegaTon, or Basic Ton. Then you must choose which of the machines will suit you best. Remember that the most affordable is the T1 Giga.

Card machine for MEI STONE

How does it work?

Stone's card machine supports the most card brands of all its competitors. It supports 28 different card brands, including debit, credit, and vouchers.

What are the advantages?

In addition to being a machine that serves a larger number of brands, it also has the advantage of having monthly subscription plans, eliminating the need to charge for sales volume.

This way, the company can calculate and choose what is most advantageous.

How do fees work?

Fees are calculated based on your company's profile. Each company receives a personalized analysis, and fees are based on this analysis.

How to apply?

To request the analysis and find out the rate that the company will make available for your business, you must enter the Stone website, fill in your details and wait for a company representative to contact you.

How to make a good choice?

To choose the best option among card machines, you need to know which criteria are most important to you.

Do you prefer to pay the lowest amount at the machine? Do you prefer to pay the lowest fees? Or do you need the machine to have a SIM card option so you don't need a cell phone?

It's also important to know how long you can wait from the sale to receipt of the money. The longer you can wait, the lower the fees will be.

So, what's the best machine for you? Leave your comment ⤵️ ⤵️ ⤵️