Credit cards for people with bad credit, find out everything about them!

Currently there are several alternatives credit card for people with bad credit, given that companies have developed measures that guarantee payment of the invoice.

Advertisements

And thanks to technology, you can also compare the best options and order without leaving home.

So, follow us to understand the types of cards for those with bad credit, as well as the best companies. Let's go:

Summary:

- What is a negative credit card and how does it work?

- Best credit card options for those with bad credit to apply for today!

- What is the best credit card for those with bad credit?

What is a negative credit card and how does it work?

A card aimed at those with bad credit is one that the company does not consult credit protection agencies such as SPC or Serasa to make available.

In this sense, all your pending issues are left aside.

But for this to happen, the company needs to protect itself from the risk of default, hence the types of credit cards for those with bad credit:

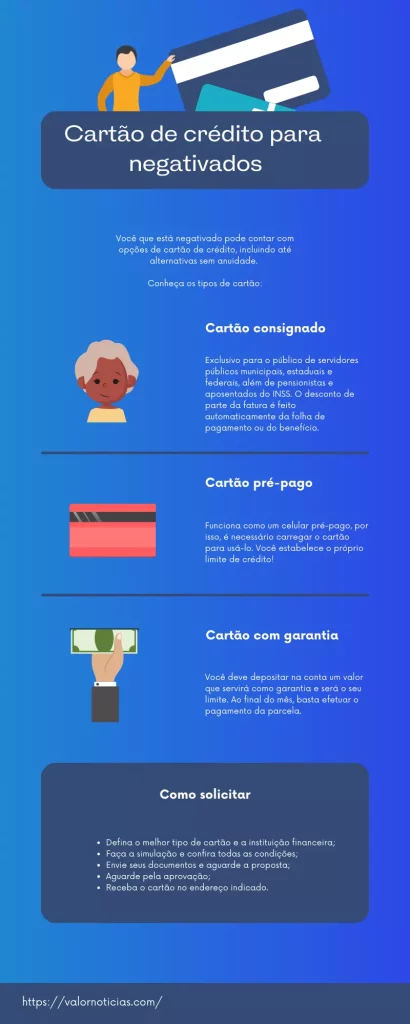

First, we have the consignment card which is exclusive to municipal, state and federal public servants, as well as pensioners and retirees.

As a differentiator, please note that the minimum invoice amount is automatically deducted from your payroll or benefit.

This means the company does not need to consult credit protection agencies for availability.

Other banks also offer exclusive benefits such as free annual fees and the ability to withdraw part of your credit limit.

On the other hand, there is the type of prepaid card which would be a new financial transaction and works like a prepaid cell phone.

Therefore, the card is used after the customer recharges it, and he is responsible for establishing the credit limit.

But, you might be thinking:

And why not use my debit card?

Well, companies rarely accept debit cards to purchase online services, such as games or streaming and music platforms.

Finally, the card with warranty is the most current modality.

To use the card, the customer must deposit an amount into the account that will serve as a guarantee and will be their limit.

However, unlike the prepaid option, you will not use the guarantee amount, as you must pay the bill at the end of the month.

The guarantee will only remain with the company if you are unable to pay the invoice.

Best credit card options for those with bad credit to apply for today!

To make your choice easier, we've decided to offer options for payroll, prepaid, and secured credit cards.

This way, you can compare and define the best one for your case:

Nubank with guarantee

This card was launched in February 2021 and to use it, simply withdraw an amount from your Nubank account using the app through the “add more limit” option.

For example, if a person wants to have R$1,000 in credit, they simply deposit the amount into their account.

After adding the limit, if this person makes a purchase of R $550, your new credit limit will be R $450.

At the end of the month, the invoice must be paid.

Therefore, as an advantage, know that you will be able to build a credit history in your name, in addition to having the possibility of setting your own limit.

Thus, this credit card for people with bad credit is in the testing phase and is only available to some customers.

Therefore, you need to be an account holder and the alternative must appear in your app.

For more information, visit company website.

Banco Pan payroll credit card

This card can be used for cash or installment purchases, as well as for withdrawals.

Part of the amount is automatically deducted from your payroll or benefit and there is no need to pay an annual fee or maintenance fee.

The limit is up to 2 times your salary and the interest rates are up to 4 times lower than the traditional card (2,70% per month).

Therefore, the request is made by company website.

Go to the simulation section and fill in the fields with your full name, date of birth, CPF, email, cell phone number, monthly income, and payment source.

It is also important to inform if you already have a payroll card.

The company will offer you a proposal that must be accepted if you agree and then send your documents.

Finally, Banco Pan sends the card to your home and you must unlock it to start using it.

Please note that only INSS retirees or pensioners, public servants, and Army employees and pensioners can apply.

BMG payroll credit card

Thirdly, we can talk about the credit card for people with bad credit of BMG, which also has part of the invoice value discounted directly.

Therefore, you can choose to pay the remainder of the invoice in the app.

As an advantage of requesting this card, know that the interest rates are lower, (2.70% per month, as determined by the National Social Security Council)

Plus, the limit is up to 1.6x your benefit or salary and there are no annuities or hidden fees.

Therefore, the request must be made in the official website of the institution, just fill out a short form with your personal details and wait for the proposal to be analyzed.

Bradesco DIN prepaid card

As with other prepaid cards, it is essential that you top up this card to use it.

In this sense, it is not possible to make purchases in installments and this is a card with no bill or annual fee.

The only fee that must be paid is the card issuance fee: R$ $15.

As for the benefits, know that you can make purchases in Brazil and abroad.

Expenses are tracked through the bank's app and withdrawals are made at the Banco24Horas network, ATMs and Bradesco Expresso.

In fact, you can get a 50% discount on movie tickets, small popcorn, juice or 500ml soda at Cinemark stores throughout Brazil.

This credit card for people with bad credit must be obtained through the company website.

So, access the link and click on the “request yours now” section.

You must fill out a form with your personal details, address and password so that Bradesco can get to know your profile.

Click “next” and submit the proposal.

Once approved, the card is issued and sent to the address provided. Unlocking and registering the 4-digit password must be done by you.

If you prefer, you can also request it in person by visiting a Bradesco Expresso correspondent.

Simple Box

Customers who request this card have access to several benefits, as part of their bill is automatically discounted.

The discounted amount refers to the 5% margin of your income (salary/retirement or pension), which is the main difference compared to a conventional credit card.

In fact, from 20% to 70% of the credit limit can be converted into cash in the account, the customer simply needs to request it at the time of signing the contract or at any other time at the branch.

However, to use your limit in cash, you will be charged revolving interest + IOF, calculated from the date the credit is credited to the date the invoice is paid.

As for the advantages of this card, know that purchases can be made worldwide, either online or in physical stores.

There is no annual fee, but there is a fee for issuing your credit card.

There are also the advantages of the Elo FLEX Platform, including the Elo Mania Club, Installation and Fixation, Basic Residential, Emergency Auto II and Elo Wi-Fi.

These Elo FLEX benefits can be exchanged on the platform.

Interest rates are up to 3 times lower than those of traditional cards, ranging from 2.7% to 3% per month for revolving credit use.

The request for this credit card for people with bad credit It is only permitted for retirees or pensioners of the INSS and Federal Public Servants (also including retirees or pensioners linked to the Federal Executive Branch), under 75 years of age.

Therefore, visit a Caixa branch if you are not a customer.

Account holders simply need to contact the company via WhatsApp at 0800 726 01 04.

INSS pensioners and retirees can use ATMs throughout Brazil.

Visit the website for more information.

Mercado Pago

This is a prepaid card that allows you to shop online or in any physical store.

To top up your card, it works like topping up a cell phone, that is, you set the best amount and can use it however you prefer.

One of the possibilities would be to make withdrawals at 24-hour ATMs and there is no need to pay a fee or annual fee to keep the card.

There is no revolving interest and the request must be made by institution's website.

If you prefer, you can also obtain the card using the app, simply access it and click on the “card” section in the menu.

In the space, register and fill in the fields with the requested data, and then wait for the order confirmation.

BanQi credit card for people with bad credit

As a last option, we can talk about the BanQi prepaid card, which has a Mastercard logo and can be used for purchases in physical stores or in the digital environment.

This way, you can hire internet services, as well as shop in online stores.

This is also an international alternative, and you'll have complete financial control, as you won't be surprised by the bill.

There's no need to wait for bank approval, just make a deposit and you can order the card.

Therefore, note that this is a safe option with no annual fee and that the customer still earns 1% back on any purchase made with the physical or virtual card, but it is interesting to check the regulations.

No revolving interest is charged on the invoice and to request it you must have a balance of at least 10 reais in your free banQi digital account.

Right after depositing the money, you request activation of your card on the app's home screen and must pay the delivery fee.

In a few minutes, you will have your prepaid card, so just visit the website to understand more.

What is the best credit card for those with bad credit?

Throughout the content, we sought to provide as many options as possible so that you could compare and decide which is best for you.

In our opinion, Nubank's credit card for those with bad credit is an excellent alternative.

The secured card acts as a gateway for those looking to build a credit history.

Therefore, when you apply, you gain the opportunity to build a financial history until you achieve a pre-approved limit.

Furthermore, one difference is that you don't have to pay a card delivery fee, unlike companies like BanQi or Caixa.

In the future, the company may gain confidence in your profile and offer its traditional credit card, which also offers many benefits, such as the Nubank Rewards program.

To that end, visit the Nubank website, in addition to the other links we've added to this content.

Only through comparison will you be able to understand which alternative meets all your needs.