Nubank credit card machine: meet NuTap!

The Nubank credit card machine is not actually a piece of equipment, but rather a technological tool.

Advertisements

Fintechs emerged with a great purpose: to use technology and innovation to create financial solutions and services that make users' lives easier.

They play a major role in the current way we pay and receive payments. Thanks to their solutions, our behavior as consumers and payers has changed for the better.

Speaking of innovation, in today's text we're going to introduce you to the newest thing on the market: Nubank credit card machine, one of the most innovative fintechs today.

Read the text and find out how this new service works, its advantages and how to start receiving payments with it. NuTap.

See below what will be covered in this post:

- What is NuTap and how does it work?

- What are the advantages of the Nubank credit card machine?

- How to install the Nubank credit card machine?

- About the Nubank PJ account;

- Conclusion.

What is NuTap and how does it work?

It's exclusive to Nubank business account customers and stands out for its convenience in receiving card payments.

All this thanks to a technology called NFC, the same one that integrates contactless credit cards.

Its operation is very simple: the customer just needs to place the card on the back of the cell phone for the transaction to be carried out.

This type of transaction is completely secure; card details and passwords are protected by encryption. Only the customer has access to their details, meaning they will not be shared with the receiving merchant.

Cards from the two main brands on the market are accepted for transactions: Visa and Mastercard.

Customers who use a digital wallet on their cell phone or smartwatch can also make payments using this tool.

What are the advantages of the Nubank credit card machine?

In addition to being 100% online and digital, meaning you can carry it everywhere with great convenience, as it will be installed on your cell phone, the NuTap machine has no rental or maintenance costs.

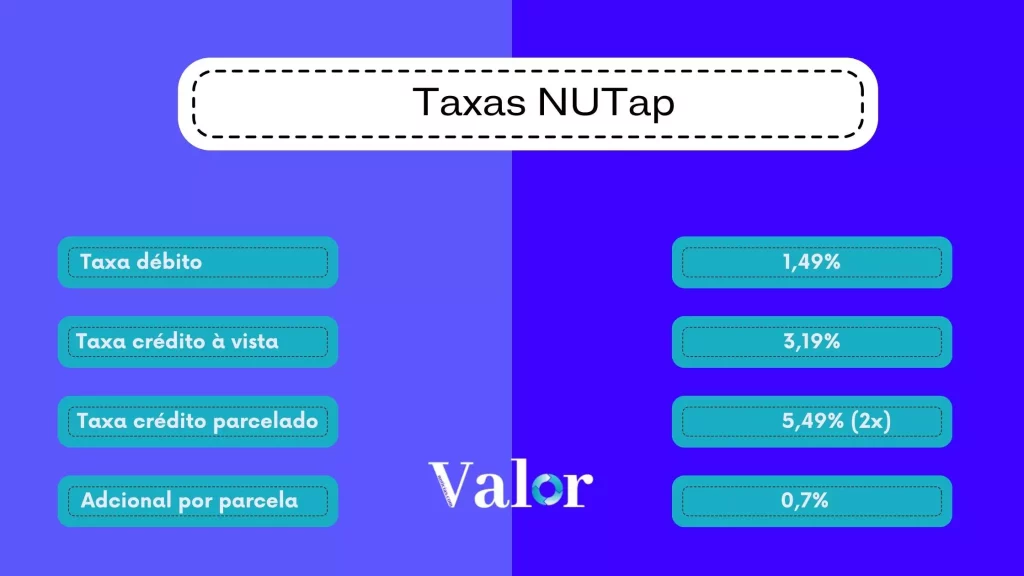

Another significant advantage is that it offers more favorable rates to its customers. Furthermore, the money is available in just one business day after the sale.

Nubank also doesn't charge a membership fee for those who want this card reader. Although it's still new to the market, it appears to be one of the most advantageous, economical, and practical options available.

Another advantage worth highlighting is that it doesn't require a battery. How many times have you had to recharge your card reader and delay receiving a payment?

This is certainly a bad thing when you are dealing with a customer who is in a hurry or impatient.

With the Nubank credit card machine the chances of this happening are greatly reduced, as this tool will depend solely on your cell phone battery.

Finally, it's also worth noting that NuTap makes it much easier to control all your transactions. This is because you can track them in real time through the app.

How to install the NuTap credit card machine?

First, you need to have a Nubank business account. Additionally, the feature must be enabled for your app.

Since it's still new, NuTap is being rolled out to customers gradually. If it's already available for installation in your app, the "Discover NuTap" option will appear in the menu.

Choose this option to read the membership terms and conditions, then click “Start using”.

Then, you'll need to wait a bit, as the bank will do a quick analysis to see if your device is eligible for the service.

If everything is correct, you'll be guided to download another app that will help you with your transactions.

Finally, you go back to the Nubank app and check if the “Charge with NuTap” option is available.

If the tool is already released, you can start using it in your business!

THE NuTap It can also be requested by phone. There's a 24-hour support line, so customers can receive guidance and ask any questions about the card machine.

Telephone: 0800 608 6236.

About the Nubank PJ account

As you can see, the Nubank credit card machine is only eligible for corporate accounts. Therefore, if you're not yet a corporate client of this fintech, we've dedicated this topic to provide some details about it.

The Nubank PJ account was created to empower small businesses by providing quality, affordable financial services that meet their core business needs.

It's a transparent legal account, with no maintenance fees or abusive charges. Plus, it's 100% digital, meaning you can handle everything from anywhere, just with your phone.

The account comes with a free debit card for easy money transfers. Not to mention, Pix is free for both receiving and making payments.

The Nubank business account also has a credit card. With this option, you can use your credit limit to invest in your business and boost sales.

Finally, it's worth noting that with this account, you can offer different payment methods to your customers, for example: bank slips, payment terminals, and payment links.

You can find out more information about this account by reading our text: 3 best digital account options for MEI.

Requesting yours is very simple. Open your Nubank digital account app and look for the "Request a Business Account" option.

Then, enter your business's CNPJ and proceed with the next steps.

If you're not yet a customer, you can open your digital account in just a few minutes. Read our article and see how. open a Nubank account and request the card.

Conclusion

THE Nubank credit card machine It is innovative, modern, economical and 100% digital.

So, be sure to try this tool and bring more practicality to your business routine!